Connect for Platforms

Connect for Platforms

Tap to Pay on iPhone

Accept contactless payments right on your iPhone with the Mollie app

Accept payments

Embedded payments

Grow your business

Technical resources

About Mollie

Tap to Pay on iPhone

Accept contactless payments right on your iPhone with the Mollie app

Accept payments

Embedded payments

Grow your business

Technical resources

About Mollie

Payments for SaaS platforms

Payments for SaaS platforms

Turn payments into a lucrative revenue stream

Turn payments into a lucrative revenue stream

Launch and scale payments effortlessly. No coding, no complexity, no engineering team required.

Launch and scale payments effortlessly. No coding, no complexity, no engineering team required.

Ordering Platform

Home

Clients

Balance

Reports

More

Balance

£

0

,

0

.

0

Volume

2024

€18,300.34

109%

2023

€8,763.94

€3K

€2K

€1K

€0

February 2024

February 2023

Volume

+328%

€2,109.12

€492.98

Transactions

+309%

45

11

Jan 24

Aug 24

Earnings

Aug ‘24

€2,500.93

150%

Sep ‘23

€998.59

€3K

€2K

€1K

€0

1 Sep

30 Sep

New clients

Last 4 weeks

31

15

10

5

0

21 Nov

28 Nov

5 Dec

12 Dec

Ordering Platform

Home

Clients

Balance

Reports

More

Balance

£

0

,

0

.

0

Volume

2024

€18,300.34

109%

2023

€8,763.94

€3K

€2K

€1K

€0

February 2024

February 2023

Volume

+328%

€2,109.12

€492.98

Transactions

+309%

45

11

Jan 24

Aug 24

Earnings

Aug ‘24

€2,500.93

150%

Sep ‘23

€998.59

€3K

€2K

€1K

€0

1 Sep

30 Sep

New clients

Last 4 weeks

31

15

10

5

0

21 Nov

28 Nov

5 Dec

12 Dec

Ordering Platform

Home

Clients

Balance

Reports

More

Balance

£

0

,

0

.

0

Volume

2024

€18,300.34

109%

2023

€8,763.94

€3K

€2K

€1K

€0

February 2024

February 2023

Volume

+328%

€2,109.12

€492.98

Transactions

+309%

45

11

Jan 24

Aug 24

Earnings

Aug ‘24

€2,500.93

150%

Sep ‘23

€998.59

€3K

€2K

€1K

€0

1 Sep

30 Sep

New clients

Last 4 weeks

31

15

10

5

0

21 Nov

28 Nov

5 Dec

12 Dec

Embed payments without risk and operational complexity

Embed payments without risk and operational complexity

Embed payments without risk and operational complexity

Embed payments without risk and operational complexity

Full-service solution: Leave KYC, risk and support to us

As many PSPs shift compliance, underwriting, and financial liability to SaaS providers, embedding payments often comes with significant risk and operational complexity. This means you may be responsible for assessing merchant risk and covering losses from insolvency, chargebacks, or fraud, all while managing customer onboarding and support.

Mollie simplifies embedded payments with a full-service solution, managing KYC, compliance, financial risks, and customer support for you. We ensure a seamless experience for your customers, so you can focus on scaling your payment business.

Fully compliant out-of-the-box

No upfront investments

No risk exposure

We take care of support for you

Our experts provide local-language support across Europe. Trusted by 250,000+ merchants, our 4.6 Trustpilot rating proves our reliability.

Easy, no-code monetisation

Set fees by customer segment or payment method, with a no-code tool your commercial team can manage without support from engineers.

Smooth onboarding, built to scale

Scale internationally, stay compliant, and keep personal data secure with a co-branded onboarding experience that drives conversions.

Monetise payments with confidence

Embedding payments into your platform enables you to scale as your customers grow.

Monetise payments with confidence

Embedding payments into your platform enables you to scale as your customers grow.

Monetise payments with confidence

Embedding payments into your platform enables you to scale as your customers grow.

Monetise payments with confidence

Embedding payments into your platform enables you to scale as your customers grow.

Payment

€50

Your customer

€48

Your platform

€2

Optimise revenue from payments

Empower your commercial team with an intuitive no-code tool to customise pricing and maximise revenue based on your payment mix. Scale confidently with expert guidance to build profitable monetisation strategies.

Visa

+

Sell rate

Mastercard

+

Sell rate

Mastercard

EUR

0.29

1.80

%

+

Edit sell rate

Visa

+

Sell rate

Mastercard

+

Sell rate

Mastercard

EUR

0.29

1.80

%

+

Edit sell rate

Visa

+

Sell rate

Mastercard

+

Sell rate

Mastercard

EUR

0.29

1.80

%

+

Edit sell rate

Flexible Resell Pricing

Set margins and rates by customer segment, individual customer, or payment method. Customise fees for specific credit card providers to avoid high buffers and keep pricing competitive.

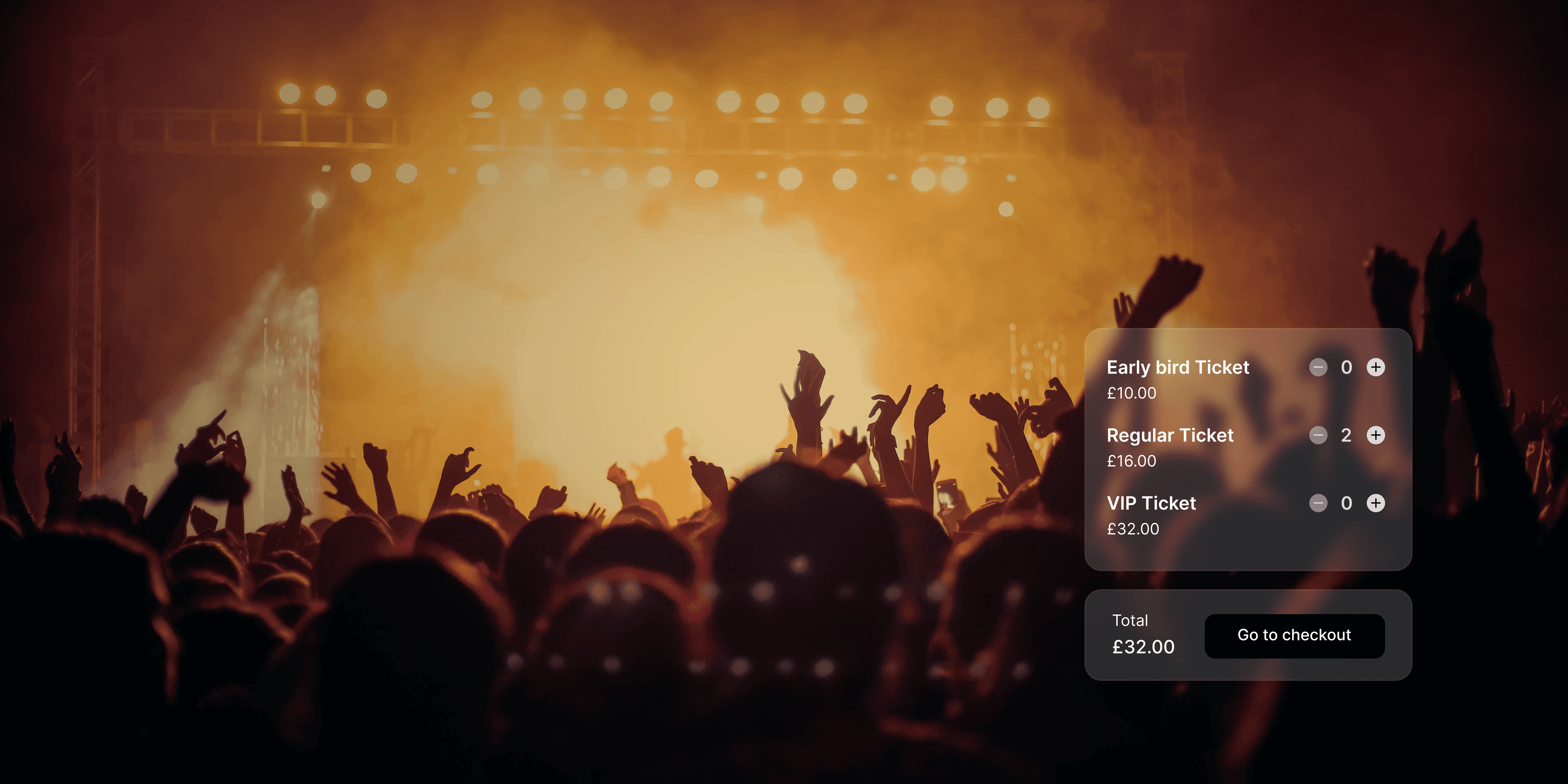

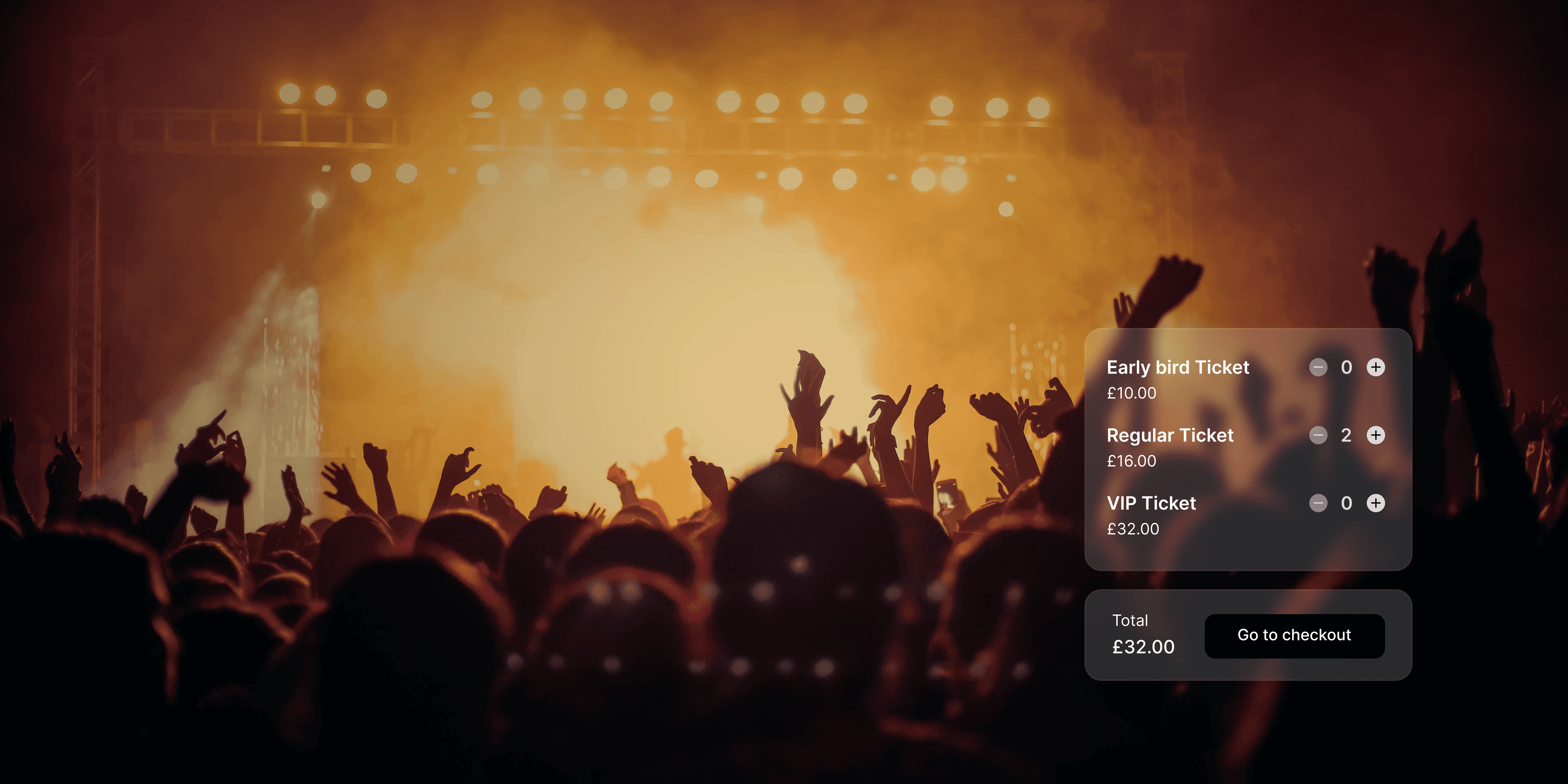

Embedded payments for Ticketing Platforms

Thoroughly managed dealings for ticket-platforms. Including all potential hazards and coping with substantial traffic increases.

Embedded payments for Booking Software

Let your customers pay directly for their booking, or let them pay later in store — fully integrated in your software, super fast onboarding.

Embedded payments for Bookkeeping Software

Give your customers extra superpowers like payment links for invoices and automatic reconciliation of transactions.

Embedded payments for Subscription Software

Add payments to your software to offer recurring payments and billing to your customers. All out of the box.

Embedded payments for Food Ordering Software

Integrate payments to your food ordering software, including super fast and easy onboarding of your customers.

Embedded payments for

No-Code Tools

Whatever tools you're building for your customers. With Mollie you can implement payments through are modern API's and offer them to your customers with ease.

Embedded payments for Ticketing Platforms

Thoroughly managed dealings for ticket-platforms. Including all potential hazards and coping with substantial traffic increases.

Embedded payments for Booking Software

Let your customers pay directly for their booking, or let them pay later in store — fully integrated in your software, super fast onboarding.

Embedded payments for Bookkeeping Software

Give your customers extra superpowers like payment links for invoices and automatic reconciliation of transactions.

Embedded payments for Subscription Software

Add payments to your software to offer recurring payments and billing to your customers. All out of the box.

Embedded payments for Food Ordering Software

Integrate payments to your food ordering software, including super fast and easy onboarding of your customers.

Embedded payments for

No-Code Tools

Whatever tools you're building for your customers. With Mollie you can implement payments through are modern API's and offer them to your customers with ease.

Onboard customers internationally

Simplify identity verification, compliance, and international scaling while securely managing personal data with Mollie’s hosted onboarding.

Onboard customers internationally

Simplify identity verification, compliance, and international scaling while securely managing personal data with Mollie’s hosted onboarding.

Onboard customers internationally

Simplify identity verification, compliance, and international scaling while securely managing personal data with Mollie’s hosted onboarding.

Quickly launch and scale your platform with Mollie

Drive revenue by simplifying every part of your platform, from accepting payments to onboarding users and routing funds.

Improve onboarding rates with with localised onboarding

Our co-branded onboarding flow keeps your brand front and centre. Pre-fill customer data with onboarding APIs for a seamless sign-up experience.

With Mollie’s growing presence in the European SMB market, new partners see 60%+ adoption, right from the start.

Co-branded onboarding

Fully managed KYC and support

Realtime onboarding

Organisation

Status

Date

Happy's Corner

Onboarding

Onboarding

Onboarding

Onboarding

05 Jan 23, 15:13

Alberto's

Completed

Completed

Completed

Completed

04 Jan 23, 21:56

Alberto's

Completed

Completed

Completed

Completed

04 Jan 23, 21:40

Pizza Express

Completed

Completed

Completed

Completed

04 Jan 23, 20:04

Sushi Time

Completed

Completed

Completed

Completed

04 Jan 23, 16:58

Restaurant Vine

Onboarding

Onboarding

Onboarding

Onboarding

04 Jan 23, 15:13

Breakfast Club

Completed

Completed

Completed

Completed

03 Jan 23, 21:56

Happy's Corner

Completed

Completed

Completed

Completed

05 Jan 23, 15:13

Alberto's

Completed

Completed

Completed

Completed

04 Jan 23, 21:56

Drinks on me

Onboarding

Onboarding

Onboarding

Onboarding

04 Jan 23, 20:04

Bar Weinig

Onboarding

Onboarding

Onboarding

Onboarding

04 Jan 23, 16:58

Happy's Corner

Onboarding

Onboarding

Onboarding

Onboarding

05 Jan 23, 15:13

Embedded payments for ticketing platforms

For ticketing platforms, seamless payments are essential. Handling high transaction volumes, both online and offline, along with refunds, security, and reconciliation is crucial.

Ticketing Platforms

Booking Software

Bookkeeping Software

Subscription Software

Food Ordering

No-code Tools

Embedded payments for ticketing platforms

For ticketing platforms, seamless payments are essential. Handling high transaction volumes, both online and offline, along with refunds, security, and reconciliation is crucial.

Ticketing Platforms

Booking Software

Bookkeeping Software

Subscription Software

Food Ordering

No-code Tools

Embedded payments for ticketing platforms

For ticketing platforms, seamless payments are essential. Handling high transaction volumes, both online and offline, along with refunds, security, and reconciliation is crucial.

Ticketing Platforms

Booking Software

Bookkeeping Software

Subscription Software

Food Ordering

No-code Tools

€10B+ per year processed through partners

Read

Paid

Empower your customers to grow

Mollie Connect lets your customers accept online payments, set up recurring payments, send invoices with payment links, and take in-person payments with ease.

Empower your customers to grow

Mollie Connect lets your customers accept online payments, set up recurring payments, send invoices with payment links, and take in-person payments with ease.

Empower your customers to grow

Mollie Connect lets your customers accept online payments, set up recurring payments, send invoices with payment links, and take in-person payments with ease.

Empower your customers to grow

Unlock new revenue and scale with a fully compliant suite of low-code solutions built for European platforms.

Leading European payment methods

Offer 35+ global and local payment options to optimise conversion rates for your customers, all through one integration.

In-person payment terminals

Allow your customers to take in-person payments using a mobile terminal, self-serve kiosk, or Tap to Pay on iPhone or Android.

Frequently asked questions

What are embedded payments in SaaS?

Embedded payments allow SaaS platforms to integrate payment processing directly into their software, so users can accept payments without needing a separate payment provider. This creates a seamless experience for businesses and their customers.

How do embedded payments work?

Embedded payments use APIs to connect a platform with a payment processor, enabling transactions within the software itself. This means users can handle payments, refunds, and payouts without leaving the platform.

What are the benefits of embedded payments for software platforms?

Software platforms benefit from increased revenue, improved user experience, and higher retention rates. By embedding payments, platforms create a more seamless workflow, reducing friction for end users.

How can SaaS companies monetise embedded payments?

SaaS companies can earn revenue by adding a margin on payment processing fees or through revenue-sharing models with a payment provider. This allows them to unlock new income streams beyond subscription fees.

Is embedding payments secure?

Yes, when using a compliant payment provider. Embedded payments leverage security measures such as encryption, tokenisation, and fraud prevention to ensure safe transactions.

What are the regulatory requirements for offering embedded payments in Europe?

Businesses must comply with PSD2 regulations, including Strong Customer Authentication (SCA), KYC (Know Your Customer), and AML (Anti-Money Laundering) requirements. Partnering with a regulated payment provider simplifies compliance.

How do embedded payments handle chargebacks and refunds?

The payment processor manages disputes, chargebacks, and refunds within the embedded payment system. SaaS platforms can automate these processes through API integrations, ensuring smooth resolution for users.

How difficult is it to integrate embedded payments into my platform?

Mollie offers easy-to-use APIs and plugins, making it simple for SaaS companies to embed payments without extensive development work.

Frequently asked questions

What are embedded payments in SaaS?

Embedded payments allow SaaS platforms to integrate payment processing directly into their software, so users can accept payments without needing a separate payment provider. This creates a seamless experience for businesses and their customers.

How do embedded payments work?

Embedded payments use APIs to connect a platform with a payment processor, enabling transactions within the software itself. This means users can handle payments, refunds, and payouts without leaving the platform.

What are the benefits of embedded payments for software platforms?

Software platforms benefit from increased revenue, improved user experience, and higher retention rates. By embedding payments, platforms create a more seamless workflow, reducing friction for end users.

How can SaaS companies monetise embedded payments?

SaaS companies can earn revenue by adding a margin on payment processing fees or through revenue-sharing models with a payment provider. This allows them to unlock new income streams beyond subscription fees.

Is embedding payments secure?

Yes, when using a compliant payment provider. Embedded payments leverage security measures such as encryption, tokenisation, and fraud prevention to ensure safe transactions.

What are the regulatory requirements for offering embedded payments in Europe?

Businesses must comply with PSD2 regulations, including Strong Customer Authentication (SCA), KYC (Know Your Customer), and AML (Anti-Money Laundering) requirements. Partnering with a regulated payment provider simplifies compliance.

How do embedded payments handle chargebacks and refunds?

The payment processor manages disputes, chargebacks, and refunds within the embedded payment system. SaaS platforms can automate these processes through API integrations, ensuring smooth resolution for users.

How difficult is it to integrate embedded payments into my platform?

Mollie offers easy-to-use APIs and plugins, making it simple for SaaS companies to embed payments without extensive development work.

Frequently asked questions

What are embedded payments in SaaS?

Embedded payments allow SaaS platforms to integrate payment processing directly into their software, so users can accept payments without needing a separate payment provider. This creates a seamless experience for businesses and their customers.

How do embedded payments work?

Embedded payments use APIs to connect a platform with a payment processor, enabling transactions within the software itself. This means users can handle payments, refunds, and payouts without leaving the platform.

What are the benefits of embedded payments for software platforms?

Software platforms benefit from increased revenue, improved user experience, and higher retention rates. By embedding payments, platforms create a more seamless workflow, reducing friction for end users.

How can SaaS companies monetise embedded payments?

SaaS companies can earn revenue by adding a margin on payment processing fees or through revenue-sharing models with a payment provider. This allows them to unlock new income streams beyond subscription fees.

Is embedding payments secure?

Yes, when using a compliant payment provider. Embedded payments leverage security measures such as encryption, tokenisation, and fraud prevention to ensure safe transactions.

What are the regulatory requirements for offering embedded payments in Europe?

Businesses must comply with PSD2 regulations, including Strong Customer Authentication (SCA), KYC (Know Your Customer), and AML (Anti-Money Laundering) requirements. Partnering with a regulated payment provider simplifies compliance.

How do embedded payments handle chargebacks and refunds?

The payment processor manages disputes, chargebacks, and refunds within the embedded payment system. SaaS platforms can automate these processes through API integrations, ensuring smooth resolution for users.

How difficult is it to integrate embedded payments into my platform?

Mollie offers easy-to-use APIs and plugins, making it simple for SaaS companies to embed payments without extensive development work.

Frequently asked questions

What are embedded payments in SaaS?

Embedded payments allow SaaS platforms to integrate payment processing directly into their software, so users can accept payments without needing a separate payment provider. This creates a seamless experience for businesses and their customers.

How do embedded payments work?

Embedded payments use APIs to connect a platform with a payment processor, enabling transactions within the software itself. This means users can handle payments, refunds, and payouts without leaving the platform.

What are the benefits of embedded payments for software platforms?

Software platforms benefit from increased revenue, improved user experience, and higher retention rates. By embedding payments, platforms create a more seamless workflow, reducing friction for end users.

How can SaaS companies monetise embedded payments?

SaaS companies can earn revenue by adding a margin on payment processing fees or through revenue-sharing models with a payment provider. This allows them to unlock new income streams beyond subscription fees.

Is embedding payments secure?

Yes, when using a compliant payment provider. Embedded payments leverage security measures such as encryption, tokenisation, and fraud prevention to ensure safe transactions.

What are the regulatory requirements for offering embedded payments in Europe?

Businesses must comply with PSD2 regulations, including Strong Customer Authentication (SCA), KYC (Know Your Customer), and AML (Anti-Money Laundering) requirements. Partnering with a regulated payment provider simplifies compliance.

How do embedded payments handle chargebacks and refunds?

The payment processor manages disputes, chargebacks, and refunds within the embedded payment system. SaaS platforms can automate these processes through API integrations, ensuring smooth resolution for users.

How difficult is it to integrate embedded payments into my platform?

Mollie offers easy-to-use APIs and plugins, making it simple for SaaS companies to embed payments without extensive development work.

Monetise payments to drive growth

Maximise revenue and simplify your payment processes to provide the best experience for both event organisers and attendees.

Monetise payments to drive growth

Maximise revenue and simplify your payment processes to provide the best experience for both event organisers and attendees.

Monetise payments to drive growth

Maximise revenue and simplify your payment processes to provide the best experience for both event organisers and attendees.

Monetise payments to drive growth

Maximise revenue and simplify your payment processes to provide the best experience for both event organisers and attendees.