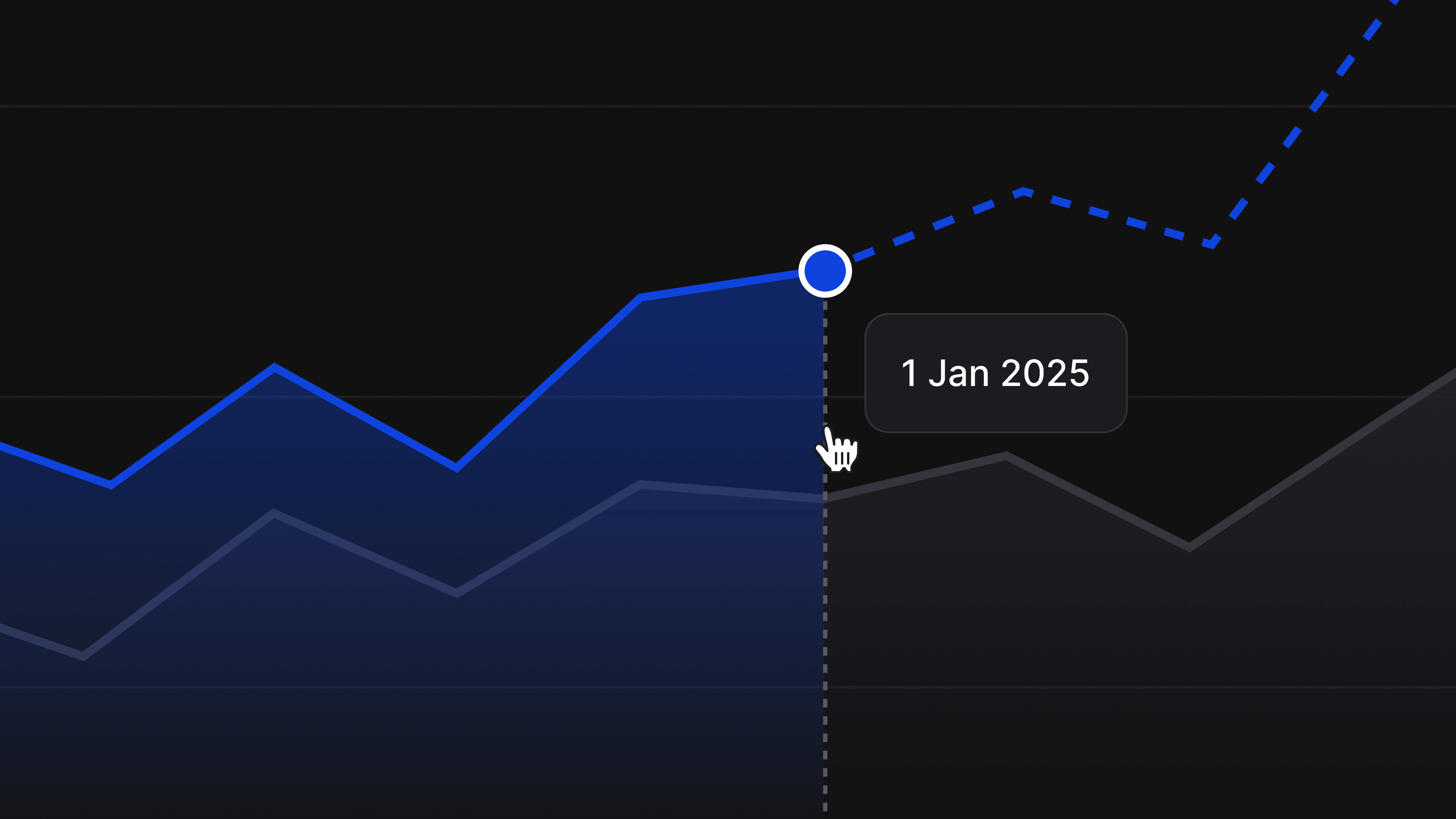

Between Home Alone, other Christmas movies, New Year’s resolutions, and frenzied shopping sprees, December and January are unique months of the year. For many e-retailers, this period is synonymous with a significant sales peak. According to a recent study, the holiday season accounts for up to 30% of annual sales for European merchants.

An optimized customer experience is therefore crucial for maximizing December sales and January clearance events. From personalizing your customer journey to the immediate impact of integrating key payment methods like American Express, explore our top tips to boost conversions and build lasting customer loyalty during this pivotal period.

Between Home Alone, other Christmas movies, New Year’s resolutions, and frenzied shopping sprees, December and January are unique months of the year. For many e-retailers, this period is synonymous with a significant sales peak. According to a recent study, the holiday season accounts for up to 30% of annual sales for European merchants.

An optimized customer experience is therefore crucial for maximizing December sales and January clearance events. From personalizing your customer journey to the immediate impact of integrating key payment methods like American Express, explore our top tips to boost conversions and build lasting customer loyalty during this pivotal period.

Between Home Alone, other Christmas movies, New Year’s resolutions, and frenzied shopping sprees, December and January are unique months of the year. For many e-retailers, this period is synonymous with a significant sales peak. According to a recent study, the holiday season accounts for up to 30% of annual sales for European merchants.

An optimized customer experience is therefore crucial for maximizing December sales and January clearance events. From personalizing your customer journey to the immediate impact of integrating key payment methods like American Express, explore our top tips to boost conversions and build lasting customer loyalty during this pivotal period.

Between Home Alone, other Christmas movies, New Year’s resolutions, and frenzied shopping sprees, December and January are unique months of the year. For many e-retailers, this period is synonymous with a significant sales peak. According to a recent study, the holiday season accounts for up to 30% of annual sales for European merchants.

An optimized customer experience is therefore crucial for maximizing December sales and January clearance events. From personalizing your customer journey to the immediate impact of integrating key payment methods like American Express, explore our top tips to boost conversions and build lasting customer loyalty during this pivotal period.